Inside Angle

From 3M Health Information Systems

HCCs: The importance of coders

After attending an AAPC presentation last year, I published a blog about HCC coding. Since then, I have continued to dive into the world of HCCs. To follow up on that initial blog, I thought it would be beneficial to discuss the importance of coders in relation to HCCs and the financial impact of correct coding.

BRIEF REFRESHER

The Centers for Medicare and Medicaid Service’s (CMS) HCC risk adjustment model calculates risk scores, which adjust capitated payments for beneficiaries who are elderly or disabled and enrolled in the Medicare Advantage program. This risk model looks at prospective data (previous year) to predetermine patient cost for the following year. Payers are paid a higher per patient per month amount from CMS for patients who have severe or chronic illnesses that cost more to treat. What drives this payment? Correct ICD-10-CM coding.

Risk adjustment requires a change in the way coders think. We are used to submitting diagnosis codes to validate reimbursement for services already rendered. For risk adjustment models, ICD-10-CM codes are submitted to calculate each patient’s risk score, which determines the financial reserves that will go toward future patient care.

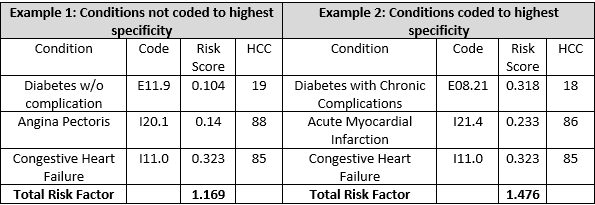

The value of correct coding cannot be overstated. Let’s look at a simple example using the Scan Risk Score calculator from HCCuniversity.com to help understand the impact to this program specifically. In the hypothetical patient example below (using current risk score information) we have a 75-year-old female, who is not institutionalized, is currently Medicare eligible due to age, and originally not Medicare eligible due to a disability:

If the per member per month (PMPM) was $2,000 for example, and we multiply this amount by each total risk factor the payment for Example 1 would be $2,338 and the total payment for Example 2 would be $2,952. This is a difference of $614per month for this patient. You can see what happens with both the risk factor for diabetes and cardiovascular conditions when the more specific ICD-10 code is used if supported by physician documentation.

So, what can coders do to make sure diagnosis codes are appropriately captured? Plenty!

- Capture diagnosis codes using the M.E.A.T. method (see Kelly Long’s blog “M.E.A.T is even better when well done”).

- Perform annual audits in your practice to identify patients with unreported chronic conditions. Providers should follow up with these patients to better manage and recapture their chronic conditions. This requires a wider focus than just presenting symptoms during an office visit.

- Confirm documentation is exclusive to the date of service (DOS).

- Watch for documentation cloning. Patient documentation should be updated based on the current encounter with your physician.

- Be careful with “history of.” Unless the condition is resolved, the provider cannot use “history of” to describe a current condition.

- Patient status conditions that impact medical decision making should be kept up to date.

- Radiology and lab findings should be included in the patient medical record.

- Documentation should be precise and detailed and if it’s not, provide physician CDI.

- Double check the assessment, impression and plan. The diagnoses assigned should align with treatment plans.

- Make sure the diagnosis code assigned is the most specific based on what has been documented for the patient!

At the end of the day, providing timely and accurate documentation and submitting correct HCC codes allows for proper reimbursement from CMS, which in turn allows health plans to provide better benefits to members and improved patient care.

Karla VonEschen is a coding analyst at 3M Health Information Systems.

Helpful HCC Resources:

CMS: Medicare Managed Care Manual, Chapter 7, Risk Adjustment: https://www.cms.gov/Regulations-and-Guidance/Guidance/Manuals/Downloads/mc86c07.pdf