Inside Angle

From 3M Health Information Systems

Demystifying Medicare Risk Adjustment

As the activity around the forthcoming 2020 election period is heating up, and with it, talk of “Medicare-For-All” options, I thought I’d begin my contribution to the Inside Angle blog with a series on how Medicare works. In this first blog I’ll attempt to demystify the philosophical underpinning, challenges with and limitations of Medicare Risk Adjustment (MRA).

Medicare beneficiaries can receive healthcare services in two basic flavors: traditional Medicare, and Medicare Advantage. What’s the difference? Traditional Medicare includes Part A (coverage for hospital services) and Part B (coverage for physician services) and is administered by a Medicare Administrative Contractor (MAC). MACs are commercially-owned entities (private or publicly held) that make coverage determinations and process claims on behalf of the Centers for Medicare and Medicaid Services (CMS). MACs pay Part A and Part B claims in the traditional fee-for-service methodology. As such, CMS retains all financial risk associated with healthcare expenditures for the entitled population. The majority of Medicare recipients continue to enroll in traditional Medicare plans and supplement the gaps in coverage with a Part D plan (drug coverage), an employer-sponsored plan, or an alternative supplemental plan (e.g. Medigap).

The Balanced Budget Act of 1997 gave birth to the Medicare Advantage program, and with it, CMS established the Medicare Risk-Adjustment process to modify the amount of remuneration paid to a Medicare Advantage Organization (MAO) for each beneficiary to cover, at a minimum, all the services afforded by traditional Medicare Parts A and B. To remain competitive in a rapidly expanding marketplace, however, almost all MA plans offer additional benefits to enrollees, including Part D (drug), dental, and optometry coverage, as well as supplemental benefits like preventative services and other wellness opportunities. Approximately one in three beneficiaries is currently enrolled in a Medicare Advantage plan.

CMS pays each MAO a fixed amount, known as a capitated payment, on a per member per month (PMPM) basis. As a result, all financial risk is shifted from CMS to the MAO. In other words, if a beneficiary uses more healthcare resources in a given year than are covered by the fixed payments from CMS, the health plan must absorb the excess costs. To offset any tendencies of a MAO to “cherry-pick” healthy beneficiaries, CMS adjusts the capitated payments according to the actuarial risk (i.e. anticipated healthcare expenses) of the MA membership. This risk-adjustment process is based on a regression model developed by CMS known as the CMS-HCC model.

The CMS-HCC model is designed to be predictive of future expenses—the determinant variable in the model. The independent variables that are used to predict future expenditures include demographic data and Hierarchical Condition Categories (HCCs). HCCs are based on diagnosis codes (ICD-10 data) submitted by recognized providers who’ve evaluated and treated the membership in an accepted location during the applicable time period—approximately one year prior to the current payment year. Most HCCs are related to chronic health conditions such as coronary heart disease and diabetes. Let’s dive further into how the model works with a hypothetical, simplified example.

Let’s say we have a 76-year-old female with Type II Diabetes, with both acute and chronic complications, and Congestive Heart Failure (CHF). According the HCC methodology, although ICD-10 codes can be submitted with the appropriate documentation to support HCC assignment, only Diabetes with acute complications and Congestive Heart Failure would be recognized. Both Diabetes with acute complications and Diabetes with chronic complications fall in the same “basket” of HCCs, therefore, the acute complication designation trumps the chronic and the chronic is dropped from the calculation.

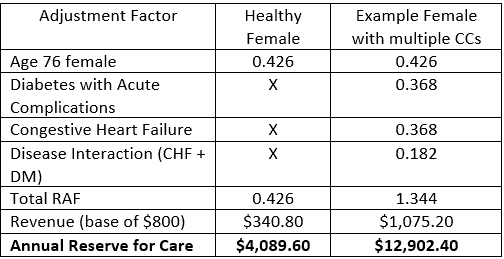

Each HCC is associated with a Risk Adjustment Factor (RAF). The RAFs are the respective coefficients produced by the CMS-HCC model. The RAFs are used in payment calculations to adjust the base revenue allocated to the health plan by CMS. Table 1 shows how the base revenue (we’ll pretend that value is $800 PMPM) would be adjusted for our example 76-year-old female according to the CMS-HCC model in comparison to a healthy 76-year-old female with the exact same demographics.

Theoretically, risk-adjusting the capitation rate from CMS to a health plan produces several beneficial effects:

- Health plans focus on identifying and managing chronic conditions which shifts the emphasis of care to prevention.

- CMS designates fiduciary responsibility to each MAO with an incentive to efficiently manage health care utilization and avoid high-cost rescue care.

- The health plan is incented to “unload” some of this subsumed financial risk to its network of providers through the creation of value-based reimbursement methodologies.

As with all advantages, however, risk-adjustment capitation results in untoward trade-offs:

- In an attempt to maximize their revenue, health plans use a tremendous amount of resources chasing missed or dropped ICD-10 codes resulting in an inherently inefficient, duplicative process

- In the chase to capture HCCs, health plans are incented to bombard the membership with “wellness” evaluations. This process can cause significant member and provider friction and dissatisfaction.

- Health plans must place a significant amount of emphasis on managing their medical losses (i.e. paying claims) to achieve a profitable margin. In other words, the system promotes underutilization of expensive, definitive procedures that have been shown to deliver high value. A perfect example would be hip replacement surgery in a Medicare beneficiary with end-stage arthritis.

So how well does the CMS-HCC model accurately predict future expenses? Researchers recruited by CMS periodically evaluate the model. The most recent published results date back to the 2018 model year. Unfortunately for health plan managers, the CMS-HCC model only accounts for, on average, about 10 – 15 percent of the expected costs. In other words, the model fails to account for up to 90 percent of the factors associated with healthcare spending in a Medicare population.

In the next article in this series, we’ll take a look at what the CMS-HCC model fails to account for with respect to healthcare expenses, as well as some theories on how the model may be improved in future versions.

Samuel Young, MD, MBA, FACS, CPE, CHCQM, CRC, is a Clinical Transformation Physician Consultant for 3M Health Information Systems.